We constantly hear about the importance of financial wellbeing. But how can we actually help our employees achieve this state? The answer lies in building up their financial literacy. While there are many ways to accomplish this, we believe that workshops are one of the most powerful approaches to financial education. In this post, we’ll share recommendations on how to run impactful financial literacy workshops for your employees.

What is financial literacy, and why is it so important?

Before we dive in, let’s explore exactly what financial literacy is and why it’s foundational to achieving financial health. Financial literacy is having the knowledge to make informed financial decisions. This can be anything from understanding how to invest at the right times to knowing how to save toward a significant milestone like a house or a car.

A lack of financial literacy is a significant problem in Australia. A survey found that fewer than half of all Australians could answer five basic financial questions correctly. The reason why this is significant is because low levels of financial literacy translates to poor financial health.

That same survey found that poverty rates among the least financially literate are twice as high compared to the most financially literate. People with lower financial literacy are also less likely to participate in household budget decisions, tend not to save as much money, and are more vulnerable to financial stress – a factor that costs Australian businesses an estimated $31.1 billion per year in lost revenue.

Related article: 5 Ways to help your employees improve their financial wellbeing

Steps to run a financial literacy workshop for employees

One of the best ways you, as the employer, can help combat these low rates of financial literacy is with education. Workshops, in particular, are a great way to get your employees engaged in their financial education. Not only are workshops interactive, but also having a large group of people at your organisation participate in them can make learning about finances less intimidating for others.

1. Identify your employees’ needs

Before you design your financial literacy workshop, it’s important to understand exactly what your employees want to gain from the experience. That’s why we recommend distributing a short survey ahead of time to figure out what your workforce most wants to learn from the workshop. This will help you design a curriculum that’s truly valuable.

For example: perhaps your workforce feels most urgently about learning how to save money – especially given the current circumstances with COVID-19. Instead, you host a workshop that’s solely focused on investing because you made an assumption about what would be interesting to the company. As a result, you disincentivise employees from joining future workshops since they’re not addressing their most pressing needs.

2. Craft a workshop series that addresses these needs

Once you have a clear understanding of what your employees want to gain from the workshop, it’s time to use that feedback to craft your workshop series. Outside of the content, there are other considerations to think about as well. Use the questions below to guide the design of your workshop:

- How many workshops will there be in total?

- How long will each workshop be?

- What will be the cadence of these workshops (bi-weekly, monthly, etc.)?

- How will we accommodate for employees in different time zones?

Make sure to answer these questions from the perspective of what’s best for your employees. So if you know many of your employees have young children, try to schedule shorter sessions that happen at a reasonable time of day. Or, better yet, have multiple session options so people can choose a time that’s best for their schedules.

Related article: 10 Ideas to help you boost your employee engagement

3. Choose a top-notch facilitator

It’s critical to choose an engaging, professional, and knowledgeable facilitator for your workshop sessions. Facilitators are trained to lead conversations about various financial subjects, but they’re not necessarily certified accountants or financial advisors.

There are a few criteria to take into consideration when choosing a facilitator. Choose an individual who has expertise in the specific topic you want to address – whether that’s budgeting or investment portfolios. Similarly, make sure they have experience facilitating in a virtual environment since most of us are still working remotely. The last thing you want is to hire someone who is uncomfortable on video calls and ends up leading an unproductive session.

4. Set expectations

It’s important to be clear with your employees about what they’ll gain from these workshops. You don’t want them to go into the experience thinking they’ll receive personalised financial advice from their facilitator. Instead, in all your communication about the workshop, let people know that the purpose of these workshops is to gain a basic understanding of important financial subjects. If they want additional resources to improve their sense of financial wellbeing, there are certainly ways you can support them! But these financial literacy workshops are solely for general education.

5. Build anticipation around the workshop

Now that you have the financial literacy workshops scheduled and in place, how do you get your employees to actually join? In addition to announcing the workshop at your next all-hands meeting, there are other creative tactics you can implement to build anticipation around the workshop:

- Set up catchy Slack reminders about the upcoming workshop

- Incentivise participation by offering a random prize drawing for those who join

- Ask the CEO to join and encourage participation

- Communicate the benefits that come with increasing financial literacy

- Take photos (or screenshots) and create a “teaser” video after the first workshop to encourage more people to join for the next one

6. Follow up with a survey

Finally, just as we started the financial literacy workshop with a survey, we want to end with one too. After the first session, ask your employees how they felt about the experience. Specifically, did they gain value from it? If not, what could have been improved? Also ask questions about the facilitator to make sure they’re the right fit for your workforce. You can then use all the feedback you collect to make adjustments before your next workshop.

Workshops are a fantastic way to help your employees with their financial literacy and, in turn, improve their sense of financial wellbeing. Use the steps we outlined above to run a financial literacy workshop that will be impactful for both your workers and your business.

If you have any employees who are in need of support, be sure to check out Wellness@Work, a free hub designed to support HR and Australian workers by giving them access to free content.

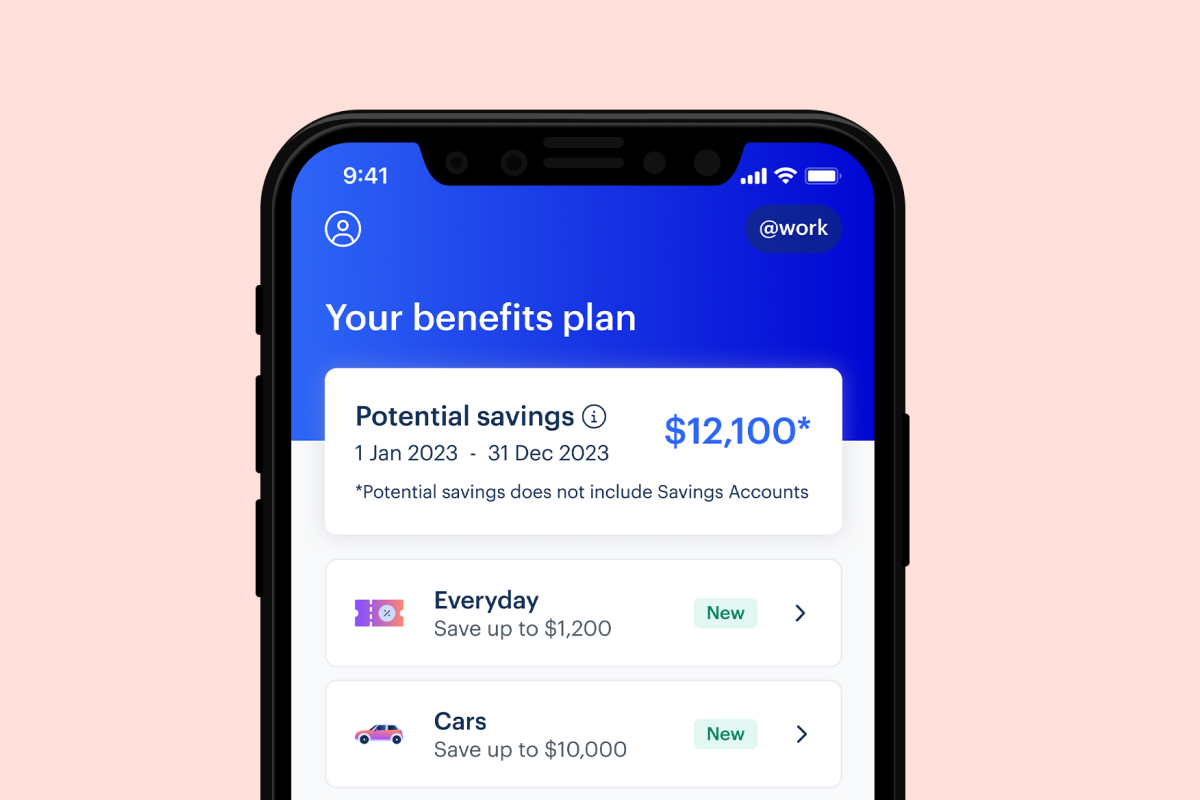

If you’re looking for an additional HR software to support your business, Flare offers a free onboarding software with employee management and benefits. To learn more, please request a demo.