Novated leasing is an innovative car financing option that allows employees to save money on their car purchase and potentially enjoying significant tax savings. Let’s explore everything you need to know about novated leasing for employees, including how it works, what happens at the end of a novated lease, the benefits, and more.

What is a novated lease?

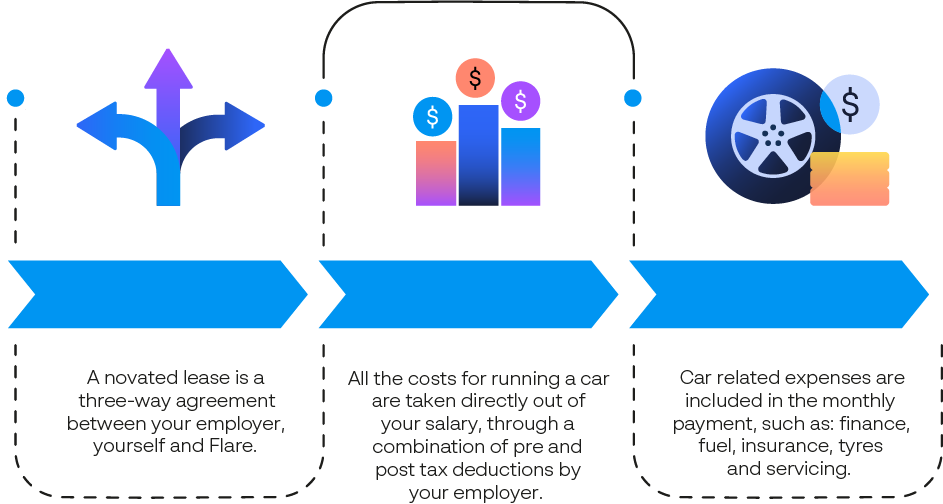

Cars are one of our biggest household expenses, yet many of us haven’t been exposed to the huge savings advantages that a novated lease can offer. It’s one of the cheapest ways to own and run your car. A novated lease is an arrangement between an employee, their employer, and a financier for a period of time, between one to five years. With a Flare novated lease, you can get the car you want now with no large upfront cost, and bundle up your vehicle finance and running costs like fuel and maintenance into convenient monthly payments. By doing this, you could make significant savings on the purchase price, your income tax, and GST too.

How does it work?

Novated leasing is a workplace benefit in which all the costs for running a car, as well as the vehicle purchase price, are taken directly out of your salary, through a combination of pre and post tax deductions by your employer.

What happens at the end of a novated lease?

You have a couple of options if you want to leave your current company. If your new employer offers novated leasing, then you should be able to transfer your novated lease over via your new employer’s salary packaging provider. Alternatively, if your new employer does not offer novated leasing, you can pay your finance directly to the financier; however, this becomes your responsibility, and you would lose the associated tax benefits.

Did you know that with a Flare Novated lease you get:

The car you want, now. No large upfront costs, plus our team will help you source your new car and organise a test drive.

The best pricing. Benefit from Flare’s buying power and save yourself the hard work. Our car experts negotiate on your behalf and secure the best EV and hybrid deals for you.

Save on tax and running costs. Enjoy significant tax savings and less GST on your car purchase, electricity mileage, servicing and maintenance.

Easy budget management. Avoid hidden expenses and spread your bills throughout the year by bundling up your finance and running costs like electricity mileage, servicing, maintenance and rego into one convenient monthly payment.

FAQ’s:

Is a novated lease worth it?

A novated lease can be an excellent option for employees who want to save money on their car expenses while enjoying significant tax savings. However, it’s essential to consider the pros and cons of novated leasing before making a decision, and as every situation is different, so is every lease agreement.

Can you novate lease a used car?

Yes, a used car can be no older than 12 years old at the end of the lease term. So for example, if you want to lease a used car over 5 years, the car must be 7 years old or newer at the start of the lease. All you’ll need to do is provide a quote from a dealer on the used car. Don’t sign any contracts to buy until you have your credit approved.

I want to lease my current car. How do I take advantage of the tax benefits of leasing?

If you own your current car outright, or owe less on existing finance than the car is worth then we can explore a lease for you under what’s called a “Sale and Leaseback” arrangement. The finance company essentially buys your vehicle from you and leases it back to you over an agreed term.

Is novated leasing only beneficial if I drive high kilometres per year?

That is no longer the case. The Federal Government changed legislation a few years back which made the benefit of leasing universal regardless of kilometres driven. So, it doesn’t matter if you’re doing 5000kms per year or 25000kms. The only thing kilometres impact are your running cost budgets for fuel, servicing and so on.