Key points:

- Understanding the problem: Financial stress affects 50% of Australian employees, harming mental health, overall wellbeing, and job performance. It is a complex issue that includes factors like inadequate income, mounting debt, unexpected expenses, and limited financial knowledge.

- The impact of financial stress in the workplace: Financial stress impacts employees’ personal lives and extends into the workplace, leading to decreased productivity and increased absenteeism. This stress is estimated to cost the Australian economy as much as AU$15 billion per year.

- Strategies for employers: Employers can actively alleviate financial stress by implementing strategies like financial wellbeing programs, offering discounts on everyday essentials, salary packaging options, education, training assistance and more.

50% of Australian employees are stressed about their finances, a figure that is slightly higher than the percentage who reported financial pressures during the height of the pandemic. Financial stress affects employees in numerous ways, impacting their wellbeing and productivity within the workplace. At Flare, we understand the significance of addressing financial stress and are committed to providing actionable strategies for employers to alleviate these pressures and create a supportive work environment.

In April 2023, we published our National Employee Benefits Index — an in-depth analysis of the work attitudes of over 1,500 working Australians, revealing key factors that contribute to both satisfaction and stress in the workplace. In this article, we leverage our research findings to explore the impact of financial stress on employees, delve into its causes, and share effective strategies to break the cycle and promote financial wellbeing.

Understanding financial stress

Our research found that, while 60% of employees are happy with their current compensation, “financial pressure” remains their largest source of stress, followed by physical and emotional health. See the full breakdown below.

Largest sources of stress

Financial stress encompasses the overwhelming burden that arises from various factors such as inadequate income, mounting debt, unexpected expenses, and limited financial knowledge. The primary causes of financial anxiety for workers across various income brackets include debt, emergency expenses, and insufficient savings. In the current economic climate, inflation is certainly one of the main sources of stress. An increasing number of employees report that compensation isn’t keeping up with the rising cost of living expenses.

The signs of financial stress in an individual can be compared to those of anxiety and other types of stress, but they specifically alter a person’s thoughts, emotions, and actions in several areas of their life, including work. How can employers recognise the signs and support their staff? The presence of one or more of the following eight symptoms might be an indication that your employee is experiencing financial difficulties:

- Feelings of anxiety or becoming depressed

- A decline in work output

- Feeling restless or agitated

- Becoming easily irritated

- Having trouble focusing

- Struggling with sleep or insomnia

- Not showing up for work

- Taking more sick days

Financial pressures not only strain employees’ personal lives but also extend into the workplace, too.

The impact of financial stress in the workplace

Stress erodes employee morale, especially when it’s related to financial concerns. Workers struggling with money issues are more likely to have conflicts with colleagues and be looking for another job. These factors can create a wide range of problems, such as difficulties in retaining employees, a higher burden on HR, and increased expenses for training.

As seen in the previous section, employees who are struggling financially often find it difficult to stay focused and engaged, resulting in decreased productivity. Employees under financial stress are almost five times more likely to acknowledge that their personal financial problems have been a distraction at work. In fact, it is estimated that stress-related issues cost the Australian economy as much as AU$ 15 billion per year, with direct costs to employers worth approximately AU$ 10 billion through absenteeism or presenteeism. It is also well-documented that mental health and stress often impact an individual’s productivity and effectiveness in the workplace. Ongoing stress can also have a detrimental impact on an individual’s physical health.

Related: Unveiling the data: the impact of employee wellbeing on performance

Strategies for employers to address financial stress

Employers have a significant role to play in alleviating the financial stress of their workers. Through understanding and targeted support, they can contribute to the well-being of their employees, fostering a workplace environment where financial stress is acknowledged and actively addressed. Improved employee well-being can lead to increased productivity, engagement, and loyalty.

Here are eight effective strategies employers can implement within their organisation:

1. Promote financial wellbeing programs:

At Flare, we advocate for comprehensive employee wellbeing programs that equip employees with the necessary tools and resources. Programs often focus on enhancing financial literacy, effective debt management, budgeting skills, and cultivating healthy financial habits. By empowering employees with knowledge and skills, employers can foster a positive financial mindset and alleviate financial stress. In fact, 59% of workers stated that participating in a financial wellness program gave them more energy to be productive at work.

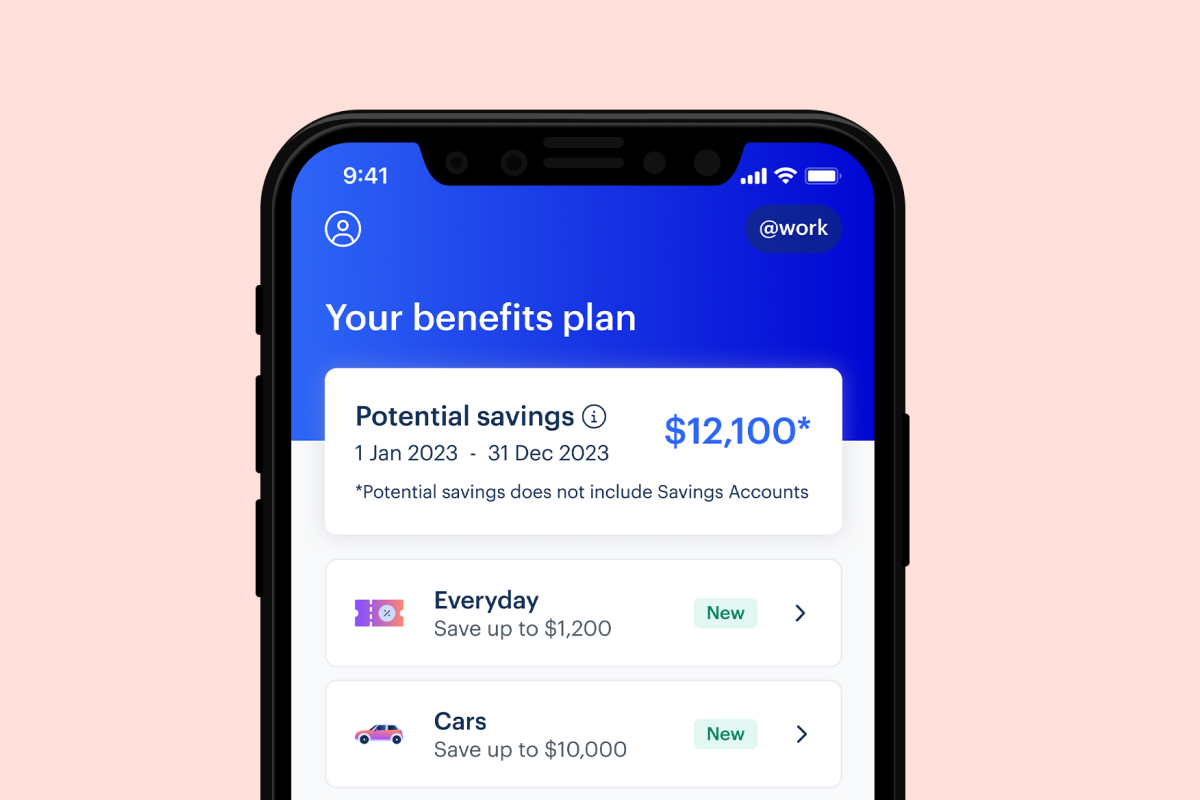

2. Offer discounts on everyday essentials:

To assist employees in managing their regular expenses, employers can provide exclusive discounts on everyday essentials, from groceries to fuel, and even fashion. These discounts can help employees save money, stretch their budgets further, and alleviate financial pressure. Flare Benefits include discounts on great brands like Woolworths, Uber, Amazon, and more.

3. Explore salary packaging options:

Salary packaging options, such as novated leasing, present an excellent opportunity for employers to support employees in getting more from their pre and post-tax salary. Given that car-related expenses are one of the biggest household costs, the savings can hold real potential. And the desire is high, with 52% of workers considering a novated lease within the next year. Learn more about salary packaging.

4. Introduce superannuation support:

Superannuation is a vital aspect of financial planning in Australia. Employers can offer workshops or access to expert advice on superannuation strategies. This helps employees understand their options better and make wise choices for their retirement, reducing long-term financial stress.

5. Provide Employee Assistance Programs (EAPs):

EAPs can include financial counselling and support as part of their services. By offering access to professional financial advisors, employers can provide tailored guidance to their staff, helping them navigate their specific financial situation and reduce anxiety around money.

6. Implement flexible work arrangements:

Recognising the cost of commuting and childcare in Australia, offering flexible work hours or telecommuting options can alleviate some of these financial burdens. This shows an understanding of employee needs and can contribute to reduced financial pressure. Our research reveals that flexible working is a strong driver of employee loyalty.

The benefits that drive employee loyalty

7. Offer education and training assistance:

The rising cost of education and professional development in Australia can be a source of stress. Flare research shows that, despite being named as a key benefit when it comes to employee loyalty, 45% of Australians feel that their employer is not dedicated to their professional development. Employers can offer financial assistance for relevant courses or training programs, encouraging continuous learning and skill enhancement without the financial strain.

8. Emphasise open communication:

Open and transparent communication about financial matters is crucial in addressing financial stress. Employers should create a safe and non-judgmental environment where employees can seek guidance, share concerns, and access support.

In addition to these strategies, a comprehensive benefits program — including elements like mental health support, mentoring, and flexible work schedules — can shape employee attitudes toward their earnings. Data from Flare’s National Employee Benefits Index shows that dissatisfaction with compensation is reduced by 25% when an organisation offers supplements to take-home pay and supports a work/life balance.

This highlights the essential role that an intentional and thoughtful benefits program can play in not only supporting financial wellness but also in building overall contentment and loyalty within the workplace.

Related: Australian workers reveal the key employee benefits that bring happiness

A new cycle: Implementing financial wellness in your organisation

Breaking free from the oppressive cycle of financial stress starts with understanding, compassion, and strategic intervention. Employers have the ability to create a new cycle — one that emphasises financial wellness, support, and empowerment.

By implementing the strategies outlined above, organisations can foster a workplace where financial wellbeing is prioritised, and stress is actively managed. This new cycle not only benefits individual employees but contributes to the overall success, productivity, and reputation of the organisation.