So, just what is Single Touch Payroll (STP)? You’ve heard the term floating around; you know it means another change is fast approaching. But there’s no need to cue the Jaws music. Rather than causing concern for payroll officers, CFOs, and managing directors, STP is poised to make your day-to-day job go that much more swimmingly.

STP is a new payroll reporting mandate from the Australian Tax Office (ATO). The mandate says that now, whenever you pay your employees, you also need to send the ATO information on:

- their salaries and wages,

- pay as you go (PAYG) withholding,

- and superannuation directly from an STP-enabled payroll solution.

If your business has 20 or more employees, these changes go into effect for you on 1 July 2018..

STP – oh, the benefits you’ll see

Certainly, like many legislation changes, managing a transition can be a challenge. Staying compliant is a top priority – who wants last-minute regulatory stress as these changes take place? You understandably want compliance to be easy, and you want to make sure you continue to fulfil all of your legal obligations.

What’s more, you’re keen to keep costs down. Fortunately, proactive preparation for your STP rollout will ultimately save you time and money.

To realise your goals, you’ll need payroll software that not only integrates well with your current systems, but also provides ongoing support for your daily tasks and responsibilities. Luckily, with today’s available technologies, you can find an easy-to-use, all-in-one payroll solution that will minimise disruption, maximise your return on investment (ROI), and generally make your life easier.

The 6 essentials of the right payroll solution for you

Choosing the right software for your STP payroll reporting ensures that you tick all the compliance boxes, undergo a seamless transition, and save time and money – all at once. These six must-have features and functions will make sure you’re prepared and positioned for success when the calendar flips to 1 July 2018.

1) STP readiness

Of course, to meet the ATO mandate, you first and foremost want to choose payroll software that’s STP-enabled. Strangely enough, according to a 2017 benchmarking report from the Australian Payroll Association, most Australian companies don’t yet have an STP plan in place – in fact, only 21.2 to 31.7 per cent, depending on company size. Make this a more proactive percentage by choosing an STP-ready solution – and soon!

2) Cloud-based systems

Cloud-based options are on the rise as more companies seek more secure and scalable systems. Ultimately, your cloud based payroll provider will be able to deploy the STP functionality without considerable workload internally., and the cloud solution will also:

- reduce paperwork and manual updates

- give you easy, 24/7 access from any internet connection

- eliminate delays in accessing and sharing information.

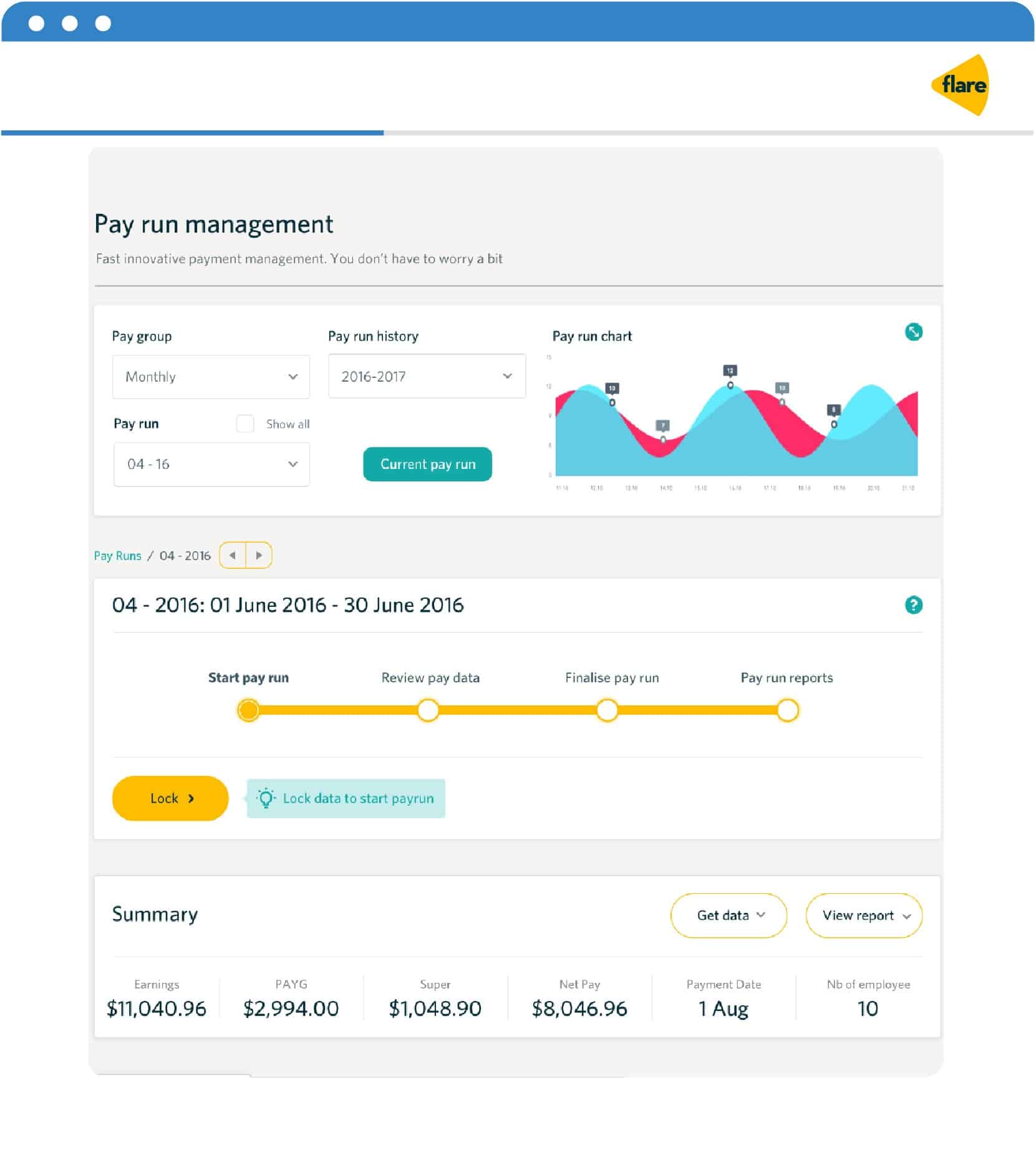

3) Advanced payroll reporting

In our increasingly data-driven world, advanced payroll reporting functionality is also high on the list of must-haves. In addition to more closely aligning your payroll function with your single touch payroll reporting obligations, having more data and analytics at your fingertips enables you to glean important insights into your business. These learnings can, in turn, help you evaluate your workforce, gauge payroll trends, assess your overall payroll strategy, and make decisions concerning employee compensation.

The 2014 HR Service Delivery and Technology Survey from global professional services company Towers Watson (now Willis Towers Watson) reveals a trend towards greater investment in HR data and analytics, portals, and payroll. In fact, the survey found this to be one of the top three areas for HR technology spending.

4) Payroll history storage

According to the Australian Government’s Fair Work Ombudsman, employers must keep time and wages records for seven years. Plus, these records must always be accessible for inspection. The department further suggests that ‘adopting best-practice record keeping makes it easier to keep track of employee details, identify payroll mistakes, and keep a business running efficiently’.

So, why not make sure your payroll solution is doing this for you? Find software with robust payroll history storage; it keeps your required payroll data all in one place – a convenient long-term function that’s especially useful when audits roll around. Make sure you keep copies of your old systems reporting data in a safe and secure place to keep the ATO happy and stay compliant.

5) Vendor-managed legal compliance updates

These days, your payroll software can also help you keep up with new and changing legal requirements for your business, providing periodic – and automated – compliance updates to ensure you’re current on the regulatory front. Check with your payroll vendor to see whether this option is available in their product; this peace-of-mind, and time-saving feature pays off in spades.

6) Integration with your other organisational systems

When you can integrate your payroll solution with other core business functions, your organisation, simply put, can run more smoothly.

First, integration helps make sure that you’ll get the most accurate results when you collect and disseminate data. By updating information in one system, it automatically updates that data across all systems, eliminating hours of your team’s time, and reducing the risk of errors.

Second, you’ll also realise significant time and cost savings by reducing the amount of admin and paperwork for your employees, increase employee engagement, and improve efficiency.

Finally, because so many payroll tasks closely connect to other human resources functions, such as onboarding and offboarding, employee training, and other benefits, it’s useful and advantageous for your HR and payroll systems to communicate well with each other.

STP simplicity

As the countdown creeps towards the first of July, proactive planning now will pay big dividends later for your single touch payroll rollout. You dont need to be ready now, but you need to make sure there’s a plan in place for July 1st..Keep your cool – and your compliance – with these steps for STP simplicity, and consider transitioning early to the ATO’s new processes for pre-emptive payroll success.