Australians are demanding more control over their pay and benefits amid mounting post-pandemic financial stress, with a new study confirming the global ‘Great Resignation’ phenomenon has arrived on our shores.

Professional services organisation Ernst & Young, Australia (EY) has collaborated with leading Australian pay and benefits platform Flare to survey 7,000 employees across the Australian economy over January–March 2022. The research findings have revealed a workforce with limited access to benefits or products that support financial wellbeing, and who are leaving their employers as their expectations change post-pandemic:

- Workers are demanding greater control over their pay and benefits: 55% report COVID-19 lockdowns have changed what they expect from an employer.

- Financial wellbeing accounted for over 50% of resignations in this period.

- Just one in three Australian employees has access to a benefits program; yet those who do believe that it meaningfully improves their pay package and financial wellbeing—and makes them less likely to leave their jobs.

- Over three quarters wish to take up key financial benefits like salary packaging.

Cashflow and payroll timing are also revealed as key financial stress factors for workers:

- Australian workers have become the largest creditors in the economy: only half are paid weekly, and one in four report being paid late—resulting in extended periods where employees are without the pay they are owed.

- 7 in 10 Australians are living paycheck-to-paycheck, with less than $5,000 in savings and an inability to meet their financial needs in an emergency.

Despite these escalating cashflow issues, 7 in 10 employees report they would never ask for a pay advance, choosing instead to take on debt to meet their cashflow needs:

- Two in three have turned to credit cards to meet their spending needs; on average, they are now nearly $3,000 in debt.

- One in five has used a personal loan or mortgage drawdown for a vital purchase.

- Two in three wait until payday to make important purchases.

The analysis notes significant merit in employers adopting benefits programs that are accessible, dynamic and go beyond a static intranet—including the option to access pay on-demand without charging interest or fees, and where value is driven by other perks like affiliate partnerships or access to a broad range of financial wellness resources.

EY Oceania Fintech Leader May Lam said, ‘What is clear from this new data is that there is a significant workforce shift underway post-pandemic. In this environment, employers of all sizes have an imperative to review the financial and personal benefits they are offering to employees, or risk being left behind as others adapt.’

Flare Co-Founder and Co-CEO James Windon said, ‘This new data reveals the balance of power in the Australian workforce has shifted towards employees. Workers are coming to expect more from their benefits: nobody should have to pay to get paid.’

‘Employers can no longer provide a static intranet and expect to retain staff. The reality for most workers is that they’re not in an office every day: they’re remote or on their feet, and need financial resources in their hands, on their smartphone,’ Windon said.

‘Flare has listened to employees, and we’re proud to be launching Australia’s first pay and benefits app available to any business for free – letting workers take employee experience into their own hands. It’s our goal to equip businesses of all sizes to compete for top talent with the resources of ASX50 companies, right across the economy.’

The Flare & EY Whitepaper ‘Pay in the new economy’, can be accessed here.

About Flare

Sydney-based fintech Flare is Australia’s leading benefits platform and pay technology provider. Flare serves over a million employees—including a quarter of Australian workers starting jobs each year; and is integrated into the leading HRIS, time-and-attendance and payroll software suites.

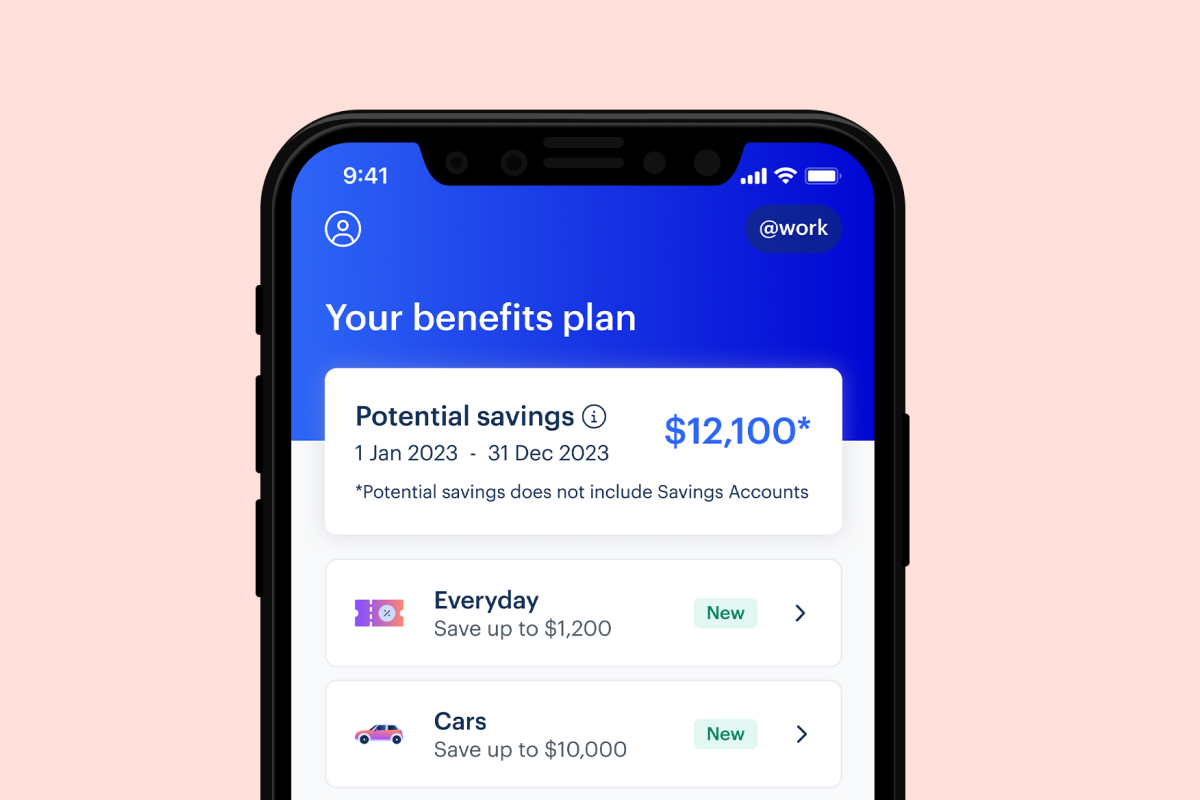

The new Flare App and Card are available for free to businesses of any size, and bring Flare’s full suite of benefits into the hands of employees, at the centre of employee engagement:

- The Flare Card gives employees the option to access their wages in real time for free—without incurring any fees, charges or interest.

- Free access to a competitive suite of perks, discounts and wellness resources from leading Australian retailers and service providers.

- Access to valuable salary packaging services to save on tax—including novated car leasing, a tax structure that saves car owners thousands of dollars per year on average.

- Better engagement with your superannuation savings—the largest benefit available to most Australians.

- Flare has partnered with Westpac, Australia’s oldest bank, to provide a full banking-as-a-service experience to employees within their workplace—launching later this year.

The Flare App and Card are rolling out now to early-access partners and will be available to the remainder of the Flare network over the course of 2022

About EY

The EY Technology and Consulting practice supports organisations as they initiate or undergo major transformations. Capabilities span end-to-end solution implementation services from consulting, strategy and architecture, to production deployment.

Media contact:

Harry Godber

0438 997 298